News

Paris, June 11, 2019 – Total and its partners have taken the investment decision for the second phase of the Mero project (Libra block), located deep offshore, 180 kilometers off the coast of Rio de Janeiro, in the prolific pre-salt area of the Santos Basin in Brazil.

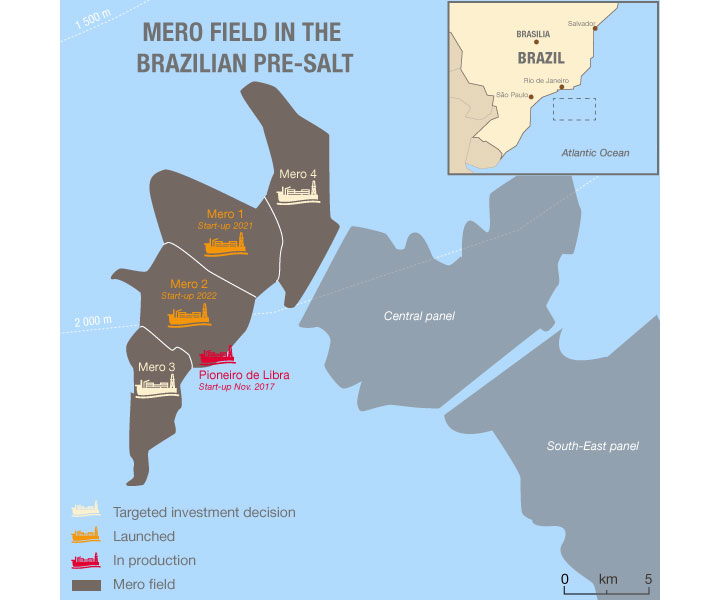

This decision follows the production start-up on the field in November 2017 (Early Production System) and the launch of the first phase of the project (Mero 1) approximately a month later.

The Mero 2 FPSO will have a liquid treatment capacity of 180,000 barrels per day and is expected to start up by 2022.

“The decision to launch Mero 2 comes as a new milestone in this large-scale project that will develop the giant oil resources of the Mero field, estimated at 3 to 4 billion barrels,” declared Arnaud Breuillac, President Exploration & Production of Total. “The Libra Consortium can leverage the excellent productivity of the field to develop a major oil project with technical costs below 20 dollars per barrel and low breakeven. The Mero project will contribute to the growth of the Group’s production from 2020 onwards. Once the full potential of the field is developed, production should reach more than 600,000 barrels per day.”

The Pioneiro de Libra FPSO, which has a capacity of 50,000 bopd and came on stream in 2017, is producing as expected while providing valuable information on the field, reservoir and productivity of the wells.

The Mero 1 project, currently under development, is progressing as per plan with a start-up scheduled in 2021.

Following the launch of Mero 2, the project is expected to add two further FPSOs of the same capacity, subject to approval by the partners. All four producing units will be deployed in the Northwestern part of the Libra block (Mero field), as the Central and South-East panels are under exploration until 2020.

The Libra Consortium is operated by Petrobras (40%) as part of an international partnership including Total (20%), Shell (20%), CNOOC Limited (10%) and CNPC (10%). Pré-Sal Petróleo (PPSA) manages the Libra Production Sharing Contract.

Total in Brazil

Total has been present in Brazil for over 40 years, has more than 3,000 employees there and operates through five affiliates in the exploration and production, gas, lubricants, chemicals and renewable energies segments.

Total Exploration & Production’s portfolio currently includes 22 blocks, located in the Campos, Santos, Barreirinhas, Ceará, Espirito Santo, Foz do Amazonas and Pelotas basins.

As part of its Strategic Alliance with Petrobras, Total holds a 22.5% stake in the Iara concession area in Block BM-S-11A and a 45% stake (subject to approval by the Brazilian authorities) as operator of Block BM-S-9A in the Lapa field concession, which came on stream in December 2016 via the 100,000 barrel per day capacity Cidade de Caraguatatuba FPSO.

Additionally, Total and Petrobras are also implementing R&D projects on different topics such as artificial intelligence leading to efficiency gains with direct applications in Brazil.

Both companies have also extended the scope of their Strategic Alliance to renewable energy. In December 2018, Total Eren and Petrobras signed a binding agreement for the creation of a Joint Venture by July 31, 2019 to develop onshore projects in the solar and wind segments in Brazil.

About Total

Total is a broad energy company that produces and markets fuels, natural gas and electricity. Our 100,000 employees are committed to better energy that is more affordable, more reliable, cleaner and accessible to as many people as possible. Active in more than 130 countries, our ambition is to become the responsible energy major.

Total contacts

Media Relations: +33 1 47 44 46 99 l [email protected] l @TotalPress

Investor Relations: +44 (0)207 719 7962 l [email protected]

Cautionary note

This press release, from which no legal consequences may be drawn, is for information purposes only. The entities in which TOTAL S.A. directly or indirectly owns investments are separate legal entities. TOTAL S.A. has no liability for their acts or omissions. In this document, the terms “Total” and “Total Group” are sometimes used for convenience where general references are made to TOTAL S.A. and/or its subsidiaries. Likewise, the words “we”, “us” and “our” may also be used to refer to subsidiaries in general or to those who work for them.

This document may contain forward-looking information and statements that are based on a number of economic data and assumptions made in a given economic, competitive and regulatory environment. They may prove to be inaccurate in the future and are subject to a number of risk factors. Neither TOTAL S.A. nor any of its subsidiaries assumes any obligation to update publicly any forward-looking information or statement, objectives or trends contained in this document whether as a result of new information, future events or otherwise.